News

3 effective ways to help combat inflation when planning your retirement

The cost of living crisis and high inflation rate have been making it incredibly challenging for UK adults in recent months.

You will have no doubt seen this impact at the supermarket checkout or when filling up at the petrol pump.

The difficult financial situation in the UK doesn’t just affect you while you’re working. It could affect the potential spending power of your pension fund and limit how much you are able to do once you’ve retired, too.

Yet many UK adults are unaware of just how inflation could affect their retirement goals. Indeed, MoneyAge reports that only 4 in 10 over-55s are factoring inflation into their retirement planning.

With the Office for National Statistics (ONS) reporting that inflation was at 6.7% in August 2023, identifying ways in which you can inflation-proof your retirement fund is becoming increasingly important.

High inflation could reduce the value of your pension in real terms

The inflation rate means that goods and services are generally more expensive than they were a year ago. As an example, the current inflation rate (as of August 2023) of 6.7% means that goods and services that cost £100 a year ago cost £106.70 now.

So, if you had planned, back in 2018, that you needed £40,000 a year from your pension to help you do everything you want to do once you’ve retired, you’ll now need significantly more, due to the effects of inflation.

Indeed, the Bank of England‘s (BoE) inflation calculator reveals that to meet those same financial goals, in 2023 you would need at least £49,601 a year from your pension.

So, read on to find out three ways you could combat inflation while planning for your retirement.

1. Use cashflow modelling in your retirement planning

While we all accept that the principle of rising costs isn’t new, the high inflation rate is making things increasingly challenging for retirees.

Above, you saw the effect of inflation on a £40,000 pension income over the course of the last five years, but your retirement could last 30 to 40 years or more. With that in mind, inflation’s influence on your pension pot could be much more pronounced.

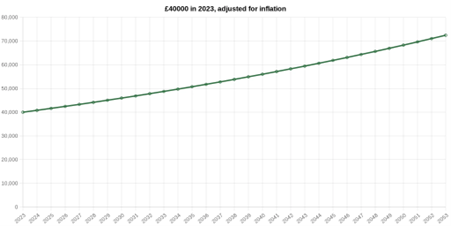

Consider your planned retirement income of £40,000 a year, starting in 2023. As you can see in the chart below, even with inflation at the BoE’s 2% target, 30 years into your retirement, the buying power of your £40,000 a year would be equivalent to £72,454 in 2053.

Source: CPI Inflation Calculator

At Simple Financial Advice, we can help you factor inflation into your retirement calculations.

We’ll use cashflow modelling software to identify how changes in inflation and your financial circumstances could affect your retirement. We’ll then work with you to help ensure you have enough to do everything you want to do in retirement.

2. Consider investments and your risk profile

Depending on your appetite for risk, you could consider putting your pension into flexi-access drawdown. This option allows you to make withdrawals from your pension pot as and when you need them, while the remainder of your money stays invested.

Leaving the rest of your pot invested could give your money the potential for inflation-beating growth.

Indeed, over the long term, equities have demonstrated the ability to outpace inflation. They could be a useful way of shielding your money from the damaging effects of inflation while at the same time securing your future financial wellbeing.

However, as with any investment, there is risk attached, so it’s worth noting that your pension pot can fall as well as rise in value.

During periods of high inflation, it’s important that you budget carefully to ensure that you don’t run out of money. Additionally, be sure to only withdraw what you need.

When you withdraw more money than you need from your pension, you’ll likely keep these funds in your bank account, where your money could be effectively losing value in real terms.

Indeed, keeping too much of your wealth in cash can often be a bad idea.

While the ONS measured inflation to be 6.7% in the 12 months to August 2023, as of 26 September 2023, the best instant access savings account rate according to Moneyfacts, was 5.10%.

So, if you withdraw more from your pension than you need to live your lifestyle, any cash you don’t spend could end up losing value in real terms while you hold it in savings.

3. Look into an inflation-linked annuity

Some of your retirement income is already inflation-proofed, such as the State Pension, which rises each year in line with economic circumstances.

Similarly, you can opt to do the same with your workplace or private pension benefits too, by purchasing an inflation-linked annuity. This will see you receive a guaranteed income for the rest of your life (or a fixed period) that rises in line with inflation each year.

By choosing this option, you could ensure that your income rises alongside increasing prices, maintaining your money’s spending power over time.

Before you commit to buying an annuity, make sure you speak to a financial planner as once you have bought one, this is typically irreversible.

Get in touch

If you’d like to discuss suitable ways for you to protect your savings and financial future, please get in touch. We’ll work alongside you to create a long-term financial strategy that can help you to achieve your goals and inflation-proof your wealth. Get in touch by calling 0800 434 6337.

Please note

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

The Financial Conduct Authority does not regulate cashflow planning.

Have My Cake And Eat It

A change in lifestyle