News

5 vital rules to be aware of to avoid overpaying tax during retirement

Throughout your working life, you will have been building up a pot of money to help you do everything you want to do when you retire.

If you have been saving diligently, you won’t want to lose some of your wealth to unnecessary taxes.

However, there can be a lot to pay attention to once you’ve stopped working. For some, this may mean that you end up paying more tax than you really need to, especially when taking your income from pensions.

Indeed, a report by FTAdviser revealed that 8.5 million pensioners were paying Income Tax in the 2023/24 tax year, compared to 7.73 million in 2022/23.

When you start taking an income from your pension, it is vital that you take your income as tax-efficiently as possible. So, read on to discover five rules to be aware of to avoid overpaying tax in retirement.

1. You can access 25% of your pension pot tax-free

As of the 2023/24 tax year, 25% of your total pension pot can be accessed tax-free, either as a one-off lump sum or spread across several smaller withdrawals. This is known as the “pension commencement lump sum” (PCLS).

If you choose to take your pension in several small lump sums, then 25% of each withdrawal will be tax-free. The remaining 75% will be subject to Income Tax at your marginal rate.

If you take more than 25% of your pension in a single lump sum, you may have to pay tax on the amount that exceeds the PCLS.

The maximum PCLS you can take tax-free in 2023/24 is £268,275. This is 25% of the Lifetime Allowance (LTA), which is £1,073,100. Although the LTA tax charge has been removed for the 2023/24 tax year, if your pension pot exceeds this amount, your PCLS will be capped unless you have LTA protection.

2. A large pension withdrawal could push you into a higher Income Tax band

Pension withdrawals that exceed both the PCLS and your Personal Allowance for the tax year may be subject to Income Tax at your marginal rate.

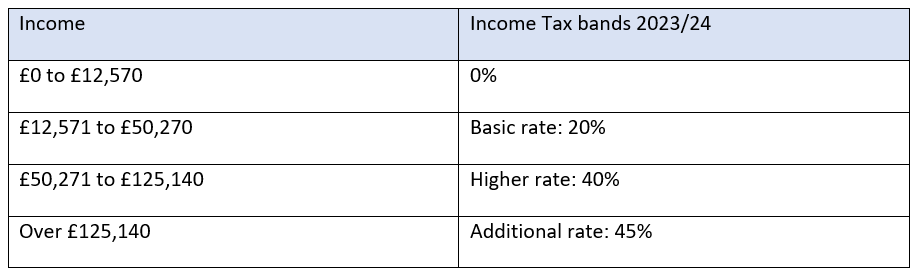

In the 2023/24 tax year, your Personal Allowance is £12,570. This is the amount of income you can receive before being taxed. If your yearly income exceeds this threshold, you may have to pay Income Tax. The amount of Income Tax you will be charged will depend on the amount of income you receive:

Your pension withdrawals will be added to any other types of income, including your State Pension and any earnings you have.

As a result, withdrawing a large lump sum from your pension could push you into a higher Income Tax band. If this happens, you may end up paying a higher rate of tax than you are used to.

Keeping a close eye on your income could help you to avoid overpaying tax. For instance, if a large pension withdrawal could push you into a higher tax band for this tax year, you might consider delaying the withdrawal until the next tax year.

Alternatively, you could consider spreading your withdrawals out over multiple tax years.

Of course, your financial planner can help you decide the most appropriate course of action for your circumstances.

3. Continuing to contribute to your pension could trigger the Money Purchase Annual Allowance

If you decide to take a phased retirement, or you return to work after retiring and contribute to your pension from your earnings, you could trigger the Money Purchase Annual Allowance (MPAA).

The MPAA limits the amount you can tax-efficiently contribute to a defined contribution pension pot in a single tax year to £10,000.

So, if you have already started flexibly withdrawing money from your pension and continue working, or return to work, this may reduce the amount that you can tax-efficiently pay into your pension.

Additionally, if you trigger the MPAA and exceed the £10,000 threshold in contributions, you could face an additional tax charge. This is why it’s important to keep a close watch on how much you pay into your pension.

4. You could overpay tax if you have income from multiple sources

When you first enter retirement, you may well be taking income from other sources, such as:

- Savings

- Investments

- Workplace pensions

- Private pensions

- State Pension

- Part-time or self-employed earnings

If this is the case, it’s important to make HMRC aware of your different income streams so that they can apply the correct tax code. If you’re on the wrong tax code, you’re likely to end up paying too much or too little tax.

Working with a financial planner can help ensure that your income is as sustainable and tax-efficient as possible.

5. Your provider may deduct emergency tax from your first pension withdrawal

If your pension provider doesn’t have an up-to-date tax code for you, your first pension withdrawal may be taxed on an emergency rate. This rate is typically higher than the normal tax code because HMRC assumes you will be drawing the same amount every month.

As such, you may end up paying more Income Tax than needed.

Indeed, a recent report by FTAdviser revealed that overpaid tax on pensions nearly doubled in a year. Between April 2023 and June 2023, HMRC repaid £56.2 million to pensioners who were charged emergency tax when they withdrew money from their pensions, up from £33.7 million in the second quarter of 2022.

If this does happen, you can claim back the additional Income Tax you paid by completing a form on the government website and submitting it to HMRC.

Get in touch

If you’d like to discuss how to maximise your income in retirement, please give us a call on 0800 434 6337. We’d be happy to help.

Please note

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

Have My Cake And Eat It

A change in lifestyle