News

Lifetime Allowance – 2 clever ways to help sidestep a 55% tax charge

An article by MoneyAge reveals that the average UK worker is on track to exceed the current pension Lifetime Allowance (LTA), which could mean they face a tax charge of up to 55% when they come to draw from their fund.

One reason for this is that many workers are unaware of the value of their pension pot, and how likely it is that they will exceed the allowance.

The risk of breaching the LTA limit has also increased after the former chancellor, Rishi Sunak, froze the LTA until 2026, meaning your pension could increase in value while the LTA limit remains static.

According to Money Marketing, the number of people facing an LTA tax charge could rise from 8,510 in 2019/20, the last tax year on record, to a predicted 29,757 by 2025. If the predictions prove correct, the Treasury could receive an estimated £1.5 billion in 2025 from tax charges linked to LTA breaches.

Read on to learn more about the LTA, and two clever steps you could take to reduce its effects on your retirement fund.

The LTA caps the amount of money in a pension that receives tax benefits

A major attraction of pensions is that contributions typically receive tax relief. This means that a basic-rate taxpayer only pays £80 for every £100 that goes into their retirement fund, and a higher-rate taxpayer pays just £60.

In some situations, additional-rate taxpayers could pay as little as £55. While you can use this to build a retirement fund of any value, the government uses the LTA to limit how much money within your pension pot receives tax relief.

In 2022/23 the LTA stands at £1,073,100, meaning that any amount in your pension that’s above this could be subject to a significant tax charge when you come to draw the funds. If you take the money as a lump sum it will be liable to a 55% charge, and if you take an income it will be liable to a 25% charge.

As the former chancellor froze the LTA until 2026 in a bid to recoup the government’s public spending during the Covid pandemic, the risk of breaching the threshold may now be higher. Let’s consider this in more detail.

Soaring inflation could push up the value of your pension pot

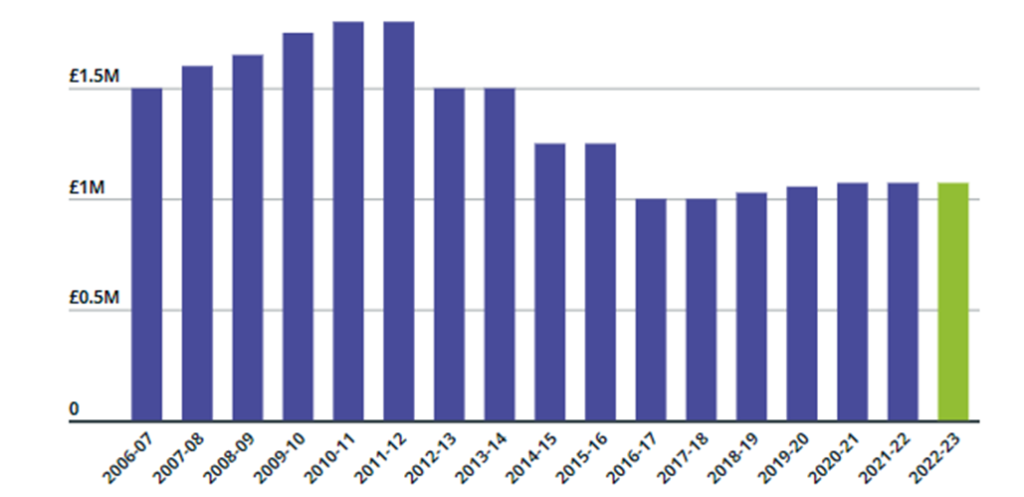

Between 2010 and 2012 the LTA was £1.8 million. It then dropped to £1 million between 2016 and 2018, before rising again in line with CPI until the 2022/23 tax year, at which point Rishi Sunak’s freeze came into force.

This can be seen in the following illustration.

Source: Which?

While the LTA remains static, the rising cost of living could increase the chances of your pension exceeding it.

This is because your earnings may rise substantially to keep pace with 2022’s soaring inflation, which means your pension contributions will probably increase too. As a result, the value of your pension pot might get a significant boost and exceed the LTA, even if it’s currently nowhere near the threshold.

The growth of your pension might mean you face an unexpected tax charge

It would be wrong to assume that your retirement fund will not exceed the LTA if its current value is significantly lower than the threshold. As pensions typically benefit from “compounding”, which is where they enjoy growth on the growth that’s already been made, your retirement fund could breach the LTA over time.

To demonstrate this, you may want to consider the following. If you use a pension growth calculator, you’ll see that a pension pot of £600,000 could exceed the current LTA in 16 years. The calculator assumes an annual growth rate of 5% a year, inflation of 2.5% a year and charges of 1.02% a year.

Depending on how much you contribute to your pension pot, you might exceed the allowance even more quickly.

There is good news though as there are steps you can take to reduce your chances of facing a tax charge. Let’s look at two now.

1. Apply for LTA protection (if applicable)

As the LTA threshold was higher in previous years, the government provided some protection against a tax charge for those with more substantial pension pots.

While many of these protections are no longer available, you may be able to apply for protection if your pension pot exceeded £1 million on 5 April 2016. A financial advisor will be able to confirm whether you’re eligible to apply.

Furthermore, they will also be able to check whether you already have protection in place.

2. Use alternative investments

Another option might be to consider reducing or stopping contributions into your pension and instead placing the money into alternative investments. For example, you may want to consider a tax-efficient Stocks and Shares ISA.

As you can contribute up to £20,000 a year into an ISA (2022/23), you could build a significant amount relatively quickly. Typically, any withdrawal you make from these tax-efficient accounts are not liable to Income Tax, and any gains made are not subject to Capital Gains Tax.

Always speak to an adviser if you are considering including investments as part of your retirement strategy, as it could carry risk and may have tax implications.

Get in touch

The first step to checking whether you could face an LTA tax charge is to get an up-to-date value of your pension. An adviser will use its current value, your contributions and your retirement fund’s growth potential to determine how likely it is that you will face a tax charge, and what your options might be.

If you would like to discuss this further, please give us a call on 0800 434 6337. We’d be happy to help.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Workplace pensions are regulated by The Pension Regulator.

Have My Cake And Eat It

A change in lifestyle