News

Sequence risk – what it is and 4 simple ways to protect your retirement plans if it affects you

According to Barclays Equity Gilt Study, if one of your ancestors had invested £100 in stocks and shares in 1899, it would have been worth around £2.7 million in 2019.

This figure highlights what many investors believe to be true which is that, over the long term, the rise in the markets typically compensate for short-term downturns along the way.

This is echoed in the illustration below, which shows how the three main investment indexes in the US recovered from the downturn in March 2020.

Source: Statista

Yet this assumption that the markets will put you ahead could be misplaced when it comes to your pension. A significant downturn just as you start retirement could have considerable implications for your plans.

This is because your pension does not have time to recover from the fall it’s experienced before you draw an income from it, which can then impact on its long-term sustainability. Known as “sequence risk”, the worst-case scenario could be that you do not have the financial ability to sustain your chosen lifestyle when you stop work.

Read on to discover more about sequence risk, what it could mean for you, and how we could help you reduce its impact should you ever find yourself affected by it.

Sequence risk means you are drawing your income from a smaller pension pot

In the financial sector there is a well-used saying when it comes to investing, which goes: “it’s time in the market, not timing the market” that matters.

In other words, if you leave your investment in the markets for long enough, it typically recovers from any downturn and starts to grow again. But what happens if you don’t have time?

As painful as it is, if you do not have time on your side – as is the case when you come to start drawing your retirement income – you have to accept that your pension pot is now smaller, and the income you intend to take will have a greater impact on your overall retirement fund.

As your pension provider needs to sell units within your pension investments to generate your income, a reduction in its value due to a market downturn in the early years means more units have to be sold to meet your expected level of income. This ultimately means your pension may not be as sustainable as it once was.

Your pension pot could run out of money during your retirement

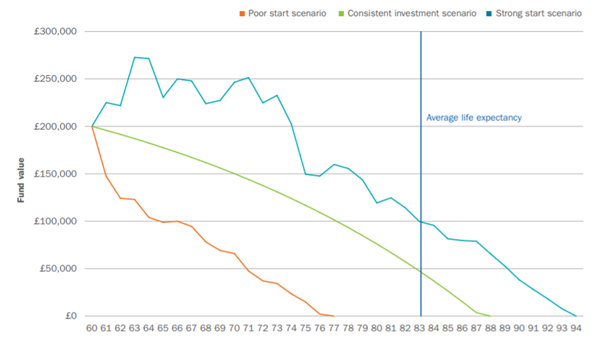

The following illustration shows the impact of sequence risk on your long-term financial future in retirement.

While it assumes the same average growth rate per annum for each of the scenarios demonstrated, it considers the impact of taking an income if your pension performs as expected (consistent investment scenario), if the pension pot enjoys a boost in value due to a market upturn (strong start) or suffers fall a in value due to a market downturn (poor start).

Source: LV=

As you can see, it makes for interesting reading. Both the consistent scenario and the strong start scenario bode well, with both running out after someone’s average life expectancy. With the poor start scenario, though, the pension is depleted more than five years before the average life expectancy.

If you were to find yourself in this situation, it may mean you living off your State Pension, which is likely to be substantially below the amount you need for your intended lifestyle.

Pension providers aim to reduce sequence risk by “lifestyling” your pension

Typically, pension providers will look to avoid sequence risk by moving your pension out of higher risk investments and into lower risk ones.

This procedure, which is called “lifestyling”, aims to lock in the accumulated growth of your pension by shielding it from significant drops in value should the markets takes a downturn. One way this can be achieved is by switching the pension investments from higher risk stocks and shares into “income generating” investments, such as gilts or government bonds.

While these provide lower levels of growth potential, they are not as exposed to market fluctuations, providing an income stream pension providers can rely on now and in the future.

That said, lifestyled pensions still have exposure to stocks and shares, as it is important to expose them to some growth in order to preserve their longevity. This means that a significant downturn in the markets – such as that experienced in March 2020 as the world dealt with the coronavirus outbreak – could still impact on your pension’s value.

So, what action could you take if you find yourself in this situation? Here are some options.

Delay drawing on your pension

If you find your target retirement age coincides with a downturn in the markets, one strategy could be to delay taking an income from your pension.

Whether you delay your retirement and continue to work, or live off savings or other investments, waiting for your pension to recover before withdrawing an income could be a sensible strategy.

Delay taking your tax-free lump sum

This dovetails into the above, as typically, you can take up to 25% of your pension pot tax free.

Taking it when your pension’s value is reduced will effectively lock in the loss your pension has experienced, while at the same time reducing the size of your pension fund. This again means it could become depleted more quickly, so waiting for your pension to recover before taking the lump sum could be the best course of action.

Reassess your retirement

If neither of the above are options, another possibility could be look at the lifestyle you were hoping for and consider whether you could take a reduced income for a short period until markets recover.

Lowering the income that you take from your pension could help extend its longevity. Using cashflow modelling – something we do with all our clients – could be key to understanding the long-term implications of reducing your income, and whether it means your pension will be sustainable.

Take natural income, not a fixed amount

Another option might be to take any growth on the pension instead of a fixed income. This means you will get more income in some years, and less income in others. However it would mean your income is not eating into the core value of your pension pot. This means it should not become depleted.

Get in touch

If you are concerned about sequence risk and would like to discuss its implications, or have any questions about your pension generally, please contact us on 0800 434 6337.

Please note:

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation which is subject to change.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

Have My Cake And Eat It

A change in lifestyle